All Categories

Featured

[/video]

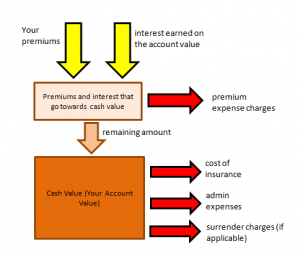

Withdrawals from the money value of an IUL are normally tax-free approximately the amount of costs paid. Any kind of withdrawals above this amount may be subject to tax obligations depending on plan framework. Conventional 401(k) contributions are made with pre-tax dollars, minimizing gross income in the year of the contribution. Roth 401(k) payments (a strategy attribute offered in most 401(k) strategies) are made with after-tax contributions and after that can be accessed (incomes and all) tax-free in retirement.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for at the very least 5 years and the person is over 59. Possessions withdrawn from a traditional or Roth 401(k) before age 59 may sustain a 10% fine. Not precisely The insurance claims that IULs can be your very own financial institution are an oversimplification and can be misleading for several reasons.

Nonetheless, you may be subject to updating linked wellness inquiries that can impact your continuous costs. With a 401(k), the money is constantly yours, consisting of vested company matching no matter whether you stop contributing. Danger and Warranties: First and foremost, IUL policies, and the cash worth, are not FDIC insured like common bank accounts.

While there is normally a floor to stop losses, the growth potential is covered (suggesting you may not completely gain from market upswings). Many specialists will certainly agree that these are not similar products. If you desire death advantages for your survivor and are worried your retired life savings will not suffice, then you may desire to take into consideration an IUL or various other life insurance policy item.

Certain, the IUL can offer accessibility to a cash money account, yet again this is not the primary objective of the product. Whether you want or need an IUL is a very private concern and relies on your primary financial purpose and objectives. However, below we will certainly try to cover advantages and restrictions for an IUL and a 401(k), so you can additionally delineate these products and make a much more informed choice regarding the very best method to take care of retired life and looking after your liked ones after death.

Indexed Universal Life Insurance Versus Life Insurance Policy

Finance Costs: Fundings against the policy accrue passion and, otherwise repaid, minimize the survivor benefit that is paid to the beneficiary. Market Engagement Limitations: For a lot of policies, financial investment development is linked to a stock market index, yet gains are usually topped, limiting upside potential - indexed universal life insurance for retirement. Sales Practices: These policies are frequently sold by insurance policy representatives that might stress advantages without fully explaining prices and risks

While some social media sites pundits suggest an IUL is a replacement product for a 401(k), it is not. These are various products with various objectives, features, and prices. Indexed Universal Life (IUL) is a sort of long-term life insurance policy plan that likewise offers a cash money value component. The cash money worth can be used for several objectives including retired life cost savings, supplementary earnings, and various other financial demands.

Latest Posts

Dave Ramsey On Iul

Universal Index Life Policy

Life Insurance Options With Ameriprise Financial